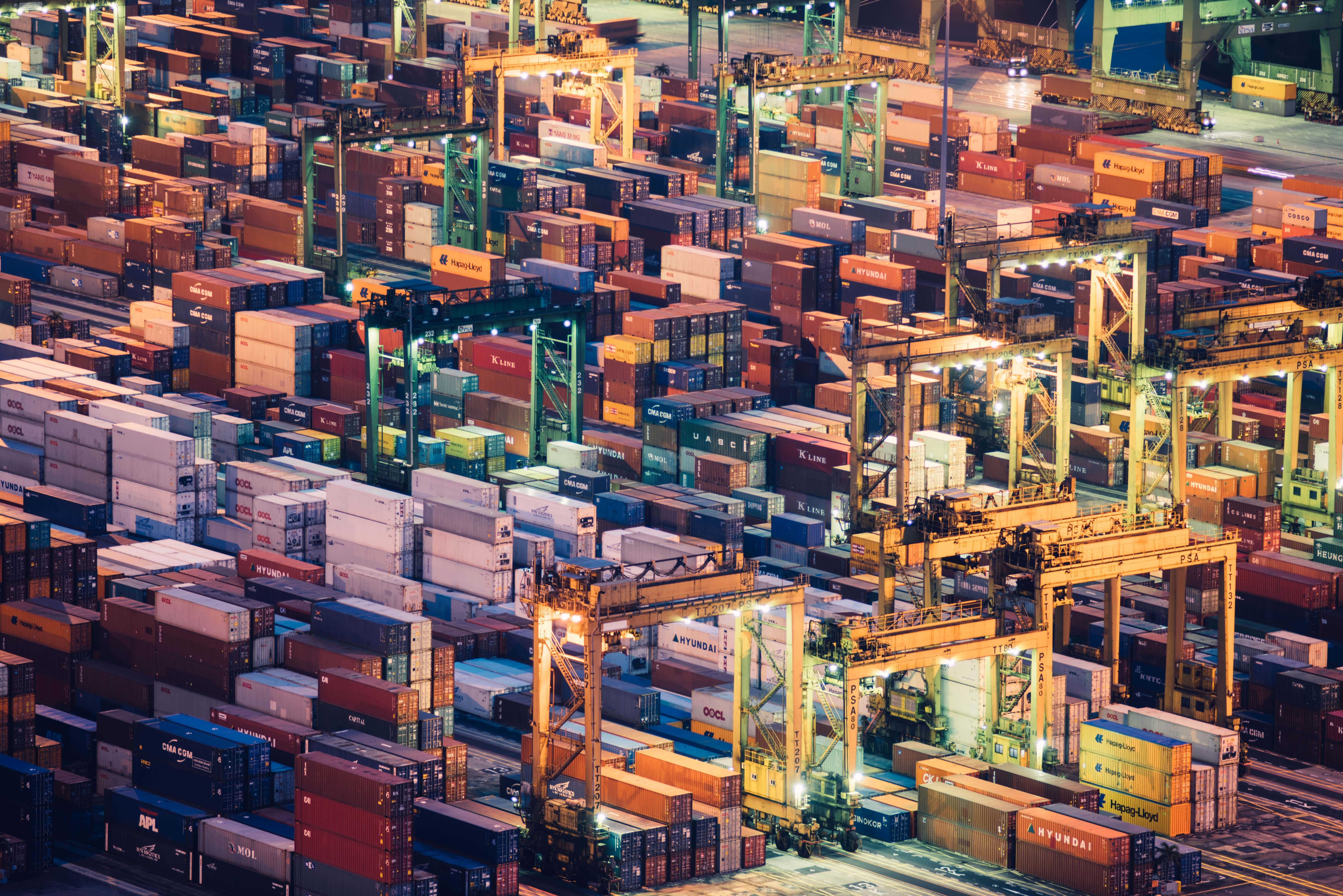

Shipping &

customs clearance

Import Customs Clearance: Step by Step Procedure

Why not leave all your headache of Importing and customs clearance process to an expert. We shall followup all the formalities and complete documentation with the fastest clearance time in all major Indian Ports.

Import Custom Clearance Step by Step Procedure for Business

Documents and Handling Customs Clearance

We shall help you prepare the checklist and handle all documents on every level of your Customs clearance Process.

6 Steps on Import Custom Clearing Services

Making it Simple

Shipment Arrives

IGM Get Filled

Checklist Generated

Bill of Entry Filled

Bill of Lading / Airway bill

Documentation & Filling

Commercial Invoice

Packing List

Certificate of Origin

Import License

Insurance certificate

Purchase order/Letter of Credit

Technical write up, literature, etc

Industrial License if any

Relevant Certificates

Test Reports, BIS, WPC, AZO

More…

Examination & Inspection

Green channel clearance

Appraisal

Assessment

Evaluation

Examination of Goods

Execution of Bonds

Payment of Duty

Transport of Goods

Purchase Waybill

Transport Documents

Insurance

Permits and Licenses

With our 5000+ Imports, and expertise we will make sure smooth customs clearance procedure for you

Importing From a Pin to Machinery and Raw material to Finished products we have been importing since 2006. with 5000 + Imports so far and counting we will make sure a seamless experience in the Clearance procedure in India.

5000+

Air & Sea Imported So far

and still counting

100000+

Diverse product expertise

in customs clearance in India

16+

Successful Businesses

Thanks to Us

Our experts will help you to complete customs clearance procedures for all your imports & exports in India.

Why not leave all your headache of Importing and customs clearance process to an expert. We shall followup all the formalities and complete documentation with the fastest clearance time in all major Indian Ports. Our team shall identify and take care of documentation which might be required from your supplier beforehand. Get in touch with us before u even place an order we can give you Landing costs till your door step.

Help Your Team Benefit From Our Experience

Use the Power of Good Project Management Solution

Complete details on Duties and Taxes

Our Professional Team will Take care of Import Custom Clearance

- HSN classification

- Rate of duty

- Processing the customs clearance

- Assessment

- Completion of appraisement and examination of various procedures and payments

- Customs examination and obtaining customs out of charge and arranging dispatch

- Delivery to the destination.

Set of Documents for Customs Clearance in non-EDI System

- Signed invoice

- Packing list

- Bill of Lading or Delivery Order/Airway Bill

- GATT declaration form duly filled in

- Importers/ CHA’s declaration

- License wherever necessary

- Letter of Credit/Bank Draft/wherever necessary

- Insurance document

- Import license

- Industrial License, if required

- Test report in case of chemicals

- Adhoc exemption order

- DEEC Book/DEPB in original

- Catalog, Technical write up, Literature in case of machinery, spares or chemicals as may be applicable

- Separately split up the value of spares, components machinery

- Certificate of Origin, if the preferential rate of duty is claimed

- No Commission declaration

The whole of the import trade from China has governed through WTO agreements entered between 52 countries around the world. The details of the same can be seen from the website mentioned below https://www.wto.org/

The customs rules and regulation can be read at the below-mentioned website: https://www.cbec.gov.in/

For Procedure for Clearance of Imported and Export Goods Please visit this link

KYC Document List:

- Authorisation letter

- Bank Signature Verification

- Bank AD code Certificate

- Pan Card of the Firm

- Partner’s/Director’s/Proprietor’s ID proof

- GST Certificate

- Company Registration Certificate

- 2 years Income Tax Returns

- IEC (Import Export Code)

Customs Clearance in All Major Indian Ports

Jawaharlal Nehru Port (or Nhava Sheva Port), Maharashtra, South Mumbai

Madras Port, Chennai

Haldia, Kolkata

Ennore, Chennai

Kochi, Kerala

Tuticorin, Chennai

Visakhapatnam, Andhra Pradesh

Kandla Port, Gujarat

Durgapur, West Bengal

Inland Container Depot, Whitefield, Bengaluru

Inland Containers Depot, Thuglakabad, New Delhi

Vallarapadam Dry Port, Kochi

Dry Port, Hyderabad

Rajiv Gandhi International Airport, Hyderabad

Indira Gandhi International Airport, Delhi

Kempegowda International Airport, Bengaluru

Chhatrapati Shivaji International Airport, Mumbai

Chennai International Airport, Chennai

Sardar Vallabhbhai Patel International Airport, Ahmedabad